Paye tax calculator

Younger than 65 years Between 65 and 75 years Older than 75 years Clear. The PAYE calculator allows you to calculate PAYE for the income years 2013 to 2022 and the information obtained may be used for AUDIT and REFERENCE purposes ONLY.

Paye Calculator Paye Net Nz

If you need to pay tax on your company car you can use this service to.

. Nairobi Expressway Toll Calculator. Not sure about earnings subject to PAYE. If you specified an annual gross salary the amount entered in the.

The IRD calculator does not include this. You can also select future and historical tax years for additional income tax calculations where figures are held if you would like to. Check your tax code - you may be owed 1000s.

It is called PAYE tax. SME Payroll tax calculator is compliant with taxation of personal income which is determined by the following laws of the Federal Republic of Nigeria. How to calculate your Contract Income Enter the average days you will work over one month eg.

PensionIf you currently have a pension enter the amount that you pay into the pension on a regular basisThis can be entered in a percentage format eg. Calculations are done at the prescribed rates and allowances at the time the emoluments are paid. Pay As You Earn PAYE Calculator.

20 - 21 days. Earn 100 switching bank. The results are broken down into yearly monthly weekly daily and hourly wages.

By default this calculator applies the Independent Earner Tax Credit IETC for incomes which would qualify. An employer is obliged to prepare and. Use SalaryBots salary calculator to work out tax deductions and allowances on your wage.

Our free online tax calculator is all you need to compare your pay under a PAYE Umbrella Company Director Umbrella Company or Personal Limited Company. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. This calculator also splits PAYE and ACC into two separate values.

PAYE Calculator Tax Year 20202021 - including UIF. UK 2022 2023. Free tax code calculator.

Income tax Te tāke moni whiwhi. So how to find the employers PAYE reference number. Nigeria adopts a Pay-As-You-Earn PAYE system to calculate the personal income tax of employees.

News updates for tax agents. PAYE reference number can also be used when employees apply for student loans tax credits and other applications. The IRD calculator combines these.

Tables for working out PAYE tax and National Insurance contributions Use the following tables to manually check your payroll calculations. Income tax for individual clients of tax agents Te tāke moni whiwhi mā ngā kiritaki takitahi a ngā takawaenga. PAYE calculator to work out salary and wage deductions.

This free tax calculator can help you in preparartion of tax returns for filing. National Insurance Contributions are calculated with a choice of eleven NIC letters spanning PAYE Class 1 CIS and Self Employed Class 2 and Class 4 types. The Nigeria Income Tax Calculator is designed for Tax Resident Individuals who wish to calculate their salary and income tax deductions for the 2022 Tax Assessment year 1 March 2022 - 28 February 2023.

After Tax UK provides an accurate tax calculator tool that helps you find out your net salary after tax and national insurance has been deducted. This calculator uses the new IRD rates post March 31st 2021 and does include the new 39 personal tax rate on remaining income over 180000. This calculator allows you to enter you monthly income for each month throughout the tax year.

Income Tax Calculator is the only UK tax calculator that is EASY to use FREE. IRD numbers Ngā tau IRD. More information about the calculations performed is available on the about page.

Pay As You Earn PAYE is the system which employers use to extract income tax and national insurance directly out of your wage to hand over to the taxman. IRD numbers Ngā tau IRD. This is an independent calculator to help the public quickly understand and calculate Pay As You Earn PAYE income tax in Kenya as set out by the Kenya Revenue Authority KRA.

4 or in a numeric format eg. Toggle navigation PAYE Calculator for 20202021. To use the calculator for the previous rates please click here.

More Business and Organisations. 2Transfer unused allowance to your spouse. The taxable income band ranges from NGN300000 to above NGN32 million in a year.

Check your company cars details tell HM Revenue and Customs HMRC about any changes to your car since 6 April. Employees and employers alike can use this calculator to under the statutory contributions liable under the income tax system of Kenya. This UK Tax Calculator will make light work of calculating the amount of take home pay you should have after all income tax deductions have been considered.

DHL Customs Duty Calculator. Pregnancy Date of Conception Calculator. Calculate your salary take home pay net wage after tax PAYE.

PAYE calculator to work out salary and wage deductions. These are wages casual wages salary leave pay sick pay payment in lieu of leave commission bonus gratuity or subsistence traveling entertainment or other allowance received during employment. UK PAYE Tax Calculator 2022 2023.

More Business and Organisations. Property Stamp Duty Calculator. This tax rate progresses from 7 percent to 24 percent of taxable income.

The calculator then provides monthly PAYE and NI deductions and an annual figure overview of deductions so you can review monthly amounts and annual averages for. 4Up to 2000yr free per child to help with childcare costs. You can disable this under the IETC settings.

Pay As You Earn PAYE is a withholding income tax for employees in. Pay As You Earn PAYE is a mandatory tax deduction done on any earnings. To use this PAYE calculator simply enter whether you are enrolled in KiwiSaver whether you have a Student Loan and your gross income then press Calculate PAYE.

See where that hard-earned money goes - with UK income tax National Insurance student loan and pension deductions. Note When entering pension in a numeric format please use the same frequency as you used to enter your gross salary. 5Take home over 500mth.

Employees with special tax codes or a student loan special deduction. 3Reduce tax if you wearwore a uniform. An obvious place to check is a P60 form a notice about an employees gross pay tax paid contributions to National Insurance etc.

NZs easiest to use PAYE Calculator and PAYE guides for business and personal calculation. Also a means for employee to verify Pay As You Earned PAYE tax deducted from his or her paycheck. Please use our.

Ontario Income Tax Calculator Wowa Ca

Taxable Income Formula Examples How To Calculate Taxable Income

Net Profit Margin Calculator Bdc Ca

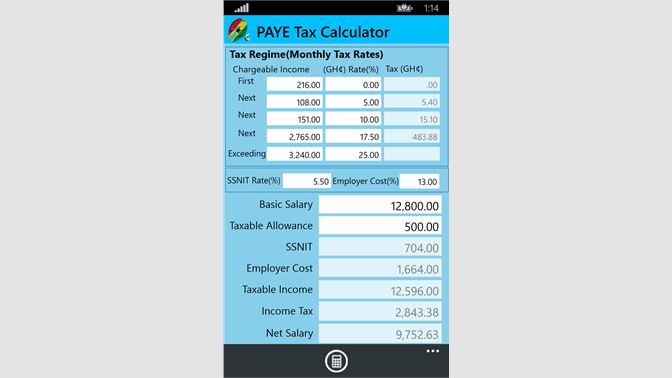

Paye Tax Calculator Pro Amazon Com Appstore For Android

Personal Income Tax Brackets Ontario 2021 Md Tax

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Payroll Taxes

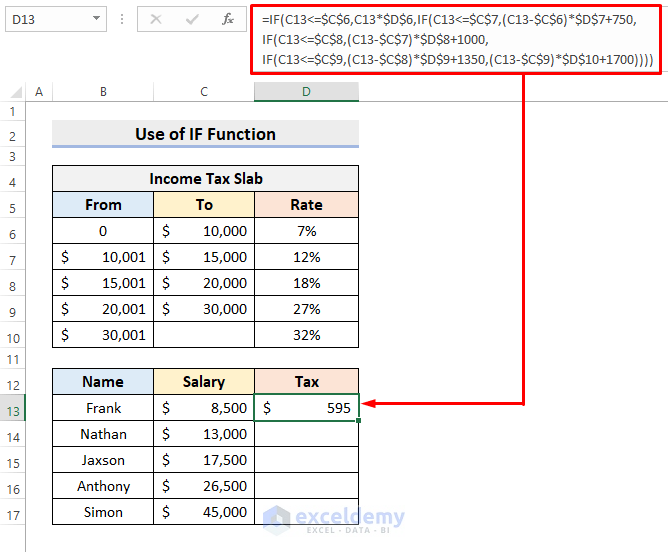

How To Calculate Income Tax In Excel Using If Function With Easy Steps

Download Income Tax Calculator Free For Pc Ccm

Net Profit Margin Calculator Bdc Ca

A Apela Cer Vacă How To Calculate Paye Tax Ninhoslings Com

30 000 After Tax 2021 Income Tax Uk

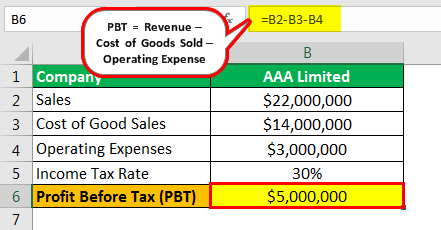

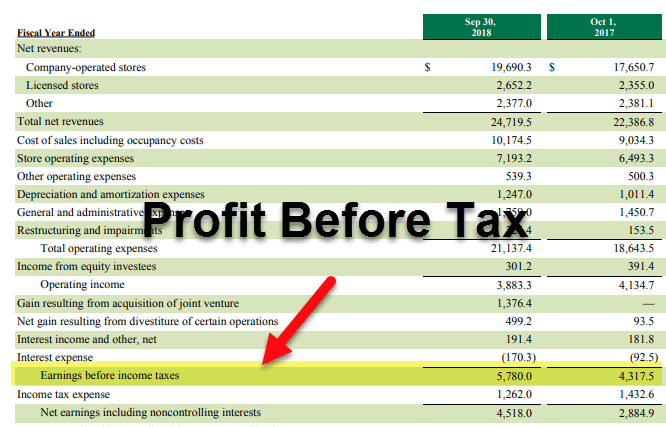

Profit Before Tax Formula Examples How To Calculate Pbt

Profit Before Tax Formula Examples How To Calculate Pbt

Tax Calculator Excel Spreadsheet Excel Spreadsheets Spreadsheet Excel

How To Calculate Income Tax In Excel

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Income Tax Co Uk Uk Tax Calculator Ever Wondered What Your Monthly Net Pay Will Be From A 30 000 Salary In The Uk For The 2020 2021 Tax Year You Will Take Home 2 003