46+ how much of my paycheck should go to mortgage

Web 2022 Federal income tax withholding calculation. Web Another monthly savings goal is 1000 per month says Eric Dostal a certified financial planner and advisor at Wealthspire Advisors in New York City.

What Percentage Of Income Should Go To Mortgage

Web The Bottom Line.

. According to the FHA monthly mortgage payments. Keep your total monthly debts including your mortgage. For example say you have a monthly gross income of 5000.

For example some experts say you should spend no more than. Apply Now With Quicken Loans. Principal interest taxes and insurance.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term. Comparisons Trusted by 55000000.

Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. Ad Compare Mortgage Options Calculate Payments. Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment.

Keep your mortgage payment at 28 of your gross monthly income or lower. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb.

Web A 15-year term. Get Instantly Matched With Your Ideal Mortgage Lender. Ad Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Were Americas Largest Mortgage Lender. The IRS allows you to deduct work related expenses on your annual tax return.

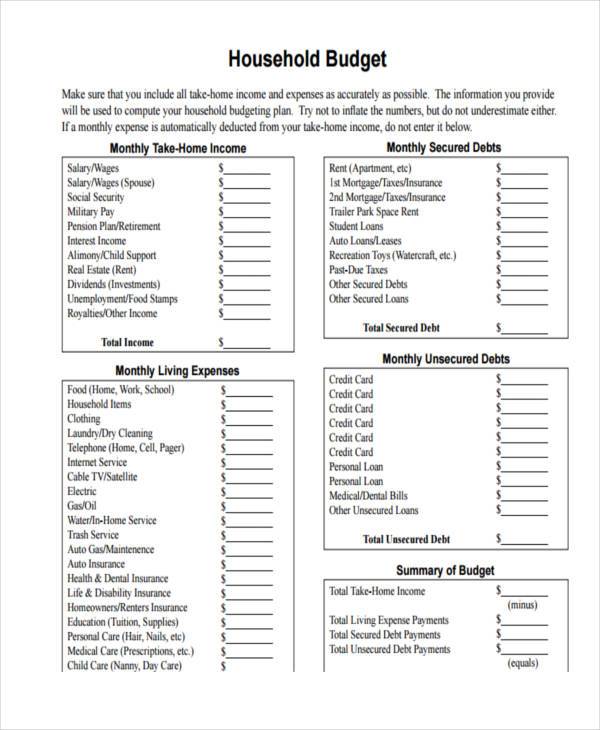

And you should make. Web Non-housing expenses include debts such as car payments student loan payments alimony or child support. So if you make 60000 per year you should think twice before.

Web But with most mortgages lenders will want you to have a DTI of 43 or less. Then multiply this number by the maximum front-end ratio. You already pay 1000.

Web You want to make sure that your monthly mortgage is no more than 28 of your gross monthly income Mark Reyes CFP and Albert financial advice expert tells. Web If you limited your monthly mortgage payment to 25 of your paycheck that translates into a mortgage of 729 per month. Lock Your Rate Today.

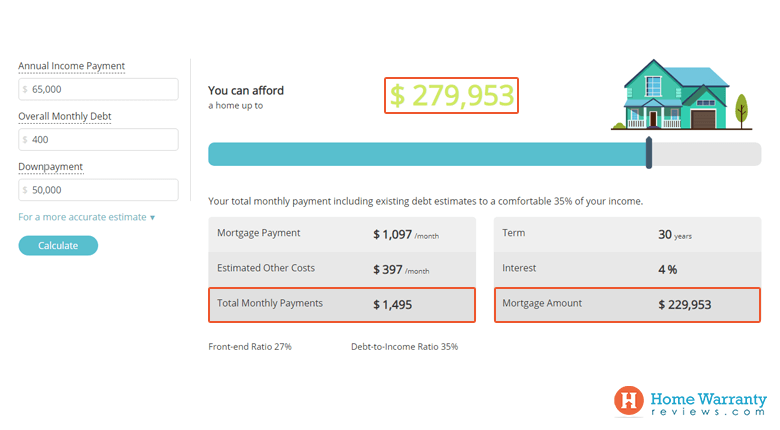

Web To find your front-end maximum first divide your annual gross income by 12 as there are 12 months in the year. Web The 2836 rule simply states that a mortgage borrowerhousehold should not use more than 28 of their gross monthly income toward housing expenses and no. Web The ideal mortgage size should be no more than three times your annual salary says Reyes.

Web The one exception is if you are required to wear a uniform and the company doesnt pay for it. Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Ad 10 Best Home Loan Lenders Compared Reviewed. Ad Calculate Your Payment with 0 Down. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Thats a lot less than the maximum. This rule says that you should not spend more than 28 of. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income.

Lock Your Mortgage Rate Today.

What Percentage Of Income Should Go To Mortgage

Free 10 Loan Payoff Statement Samples In Pdf

Home Affordability Calculator

How Much To Spend On A Mortgage Based On Salary Experian

What Percentage Of Your Income Should Go To Mortgage Chase

What Percentage Of Income Should Go To A Mortgage Bankrate

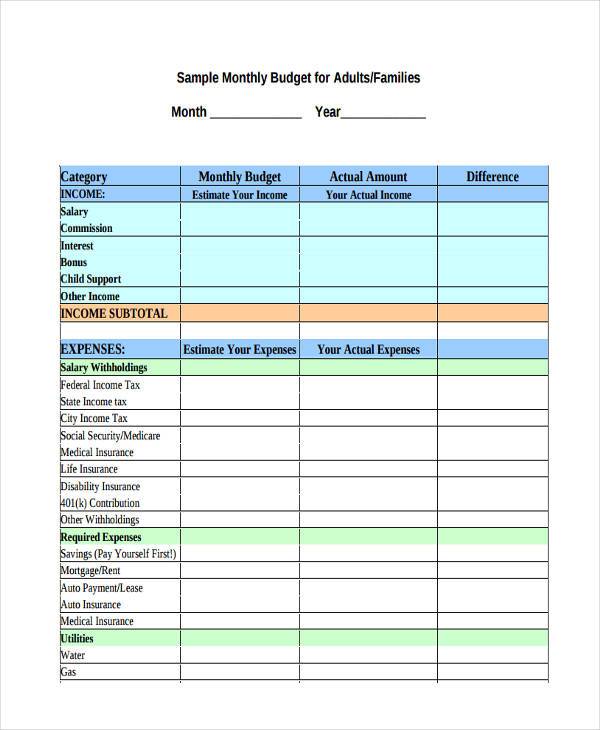

Free 46 Budget Forms In Pdf Ms Word Excel

Free 10 Loan Payoff Statement Samples In Pdf

What Percentage Of Your Income Should Go To Mortgage Chase

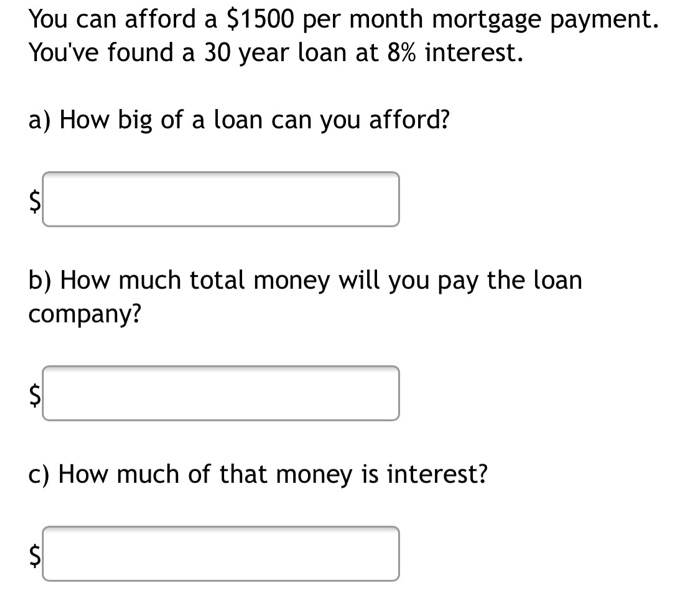

Solved You Can Afford A 1500 Per Month Mortgage Payment Chegg Com

Affordability Calculator How Much House Can I Afford Zillow

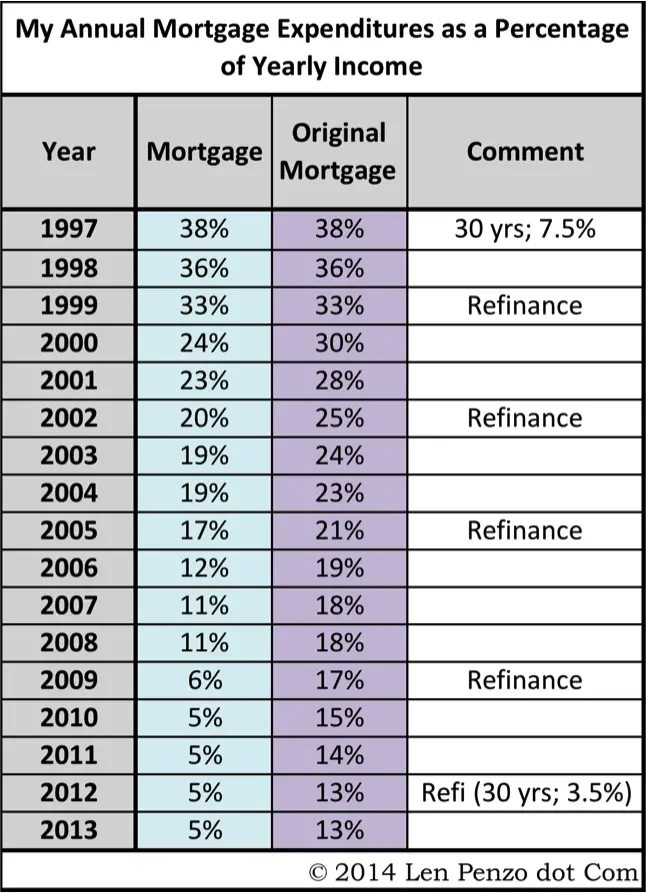

Why Paying Off The Mortgage Early May Be A Big Mistake

How Much Should My Mortgage Be Compared To My Income

What Percentage Of Your Income Should Go To Mortgage Chase

Free 46 Budget Forms In Pdf Ms Word Excel

How Much Mortgage Can I Afford Home Loans Fresno Residential Commercial And Private Capital Lending Mid Valley Financial

Walletburst Fire Calculator Financial Independence Retire Early